Every financial journey begins with a choice. Two paths, both tempting. One feels safer, the other feels freer. Which road would you take? For many, that decision often comes down to secured vs unsecured loans, a crossroads that’s about more than just borrowing money. It is about weighing security against freedom, and choosing the kind of financial journey you want to take.

When it comes to secured vs unsecured loans, knowledge is your strongest tool. The more you understand, the clearer your path becomes. Keep reading, you will uncover insights that can guide your next step.

What’s Inside:

-

- Understanding Loan Basics: What Makes a Loan Secured or Unsecured

- Secured vs Unsecured Loans: Key Differences Every Borrower Should Know

- Choosing the Right Loan: Factors to Consider Based on Your Financial Situation

- Tips for Managing Loan Risks and Protecting Your Credit Score

- Secured vs Unsecured Loans: Choose the Right Path with National Finance

Understanding Loan Basics: What Makes a Loan Secured or Unsecured

Before comparing secured and unsecured loans side by side, it is important first to understand what these terms actually mean. At their core, loans fall into one of two categories: secured or unsecured, and the key difference lies in the collateral.

What is a Secured Loan?

A secured loan is a type of loan that requires you to provide an asset, often called collateral, as security. This could be something valuable you own, such as household equipment or another asset acceptable to the lender. The collateral gives the lender confidence because if the borrower is unable to repay, the lender has the legal right to recover the loan by selling the asset.

For example, if you are seeking funds to purchase a reliable vehicle for work or invest in essential household needs, the lender may use that item as security for the loan. Because the risk to the lender is lower, secured loans often allow you to borrow larger amounts or enjoy lower interest rates.

What is an Unsecured Loan?

An unsecured loan, on the other hand, does not require any collateral. Instead, the lender bases their decision on your income, employment stability, and repayment history.

These loans are usually smaller and may carry higher interest rates since the lender takes on more risk. They are often used for immediate needs such as paying school fees, covering unexpected medical bills, or purchasing essential items for your home.

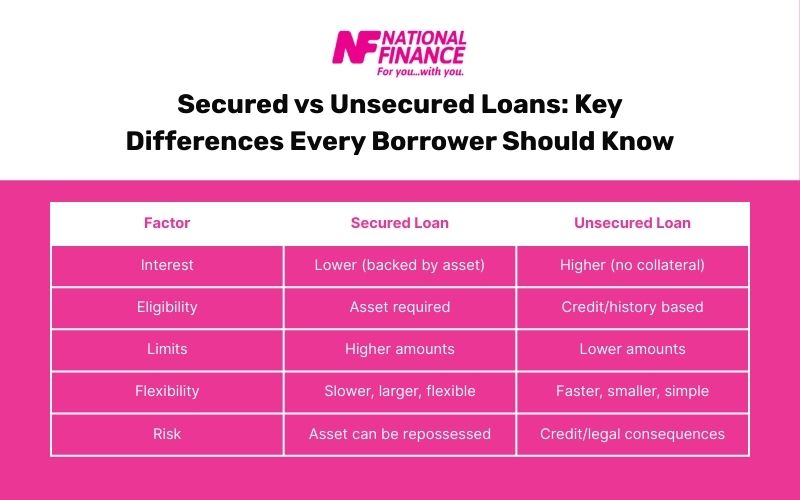

Secured vs Unsecured Loans: Key Differences Every Borrower Should Know

Each type of loan carries its own pros, cons, and risks, and the right choice often depends on your financial situation, goals, and comfort with risk. Let’s break it down side by side.

Interest Rates

Secured loans typically come with lower interest rates. Why? Because the lender has your asset, such as a car, home, or savings, as security. This reduces their risk and allows them to pass on more competitive rates. Unsecured loans, on the other hand, don’t have that safety net, so lenders usually charge higher interest to balance out the greater risk.

Eligibility

Getting approved for a secured loan is often easier if you own an asset that can be used as collateral. For unsecured loans, approval depends more heavily on your credit score, income stability, and overall financial history. If your credit record isn’t strong, a secured loan might give you more borrowing options.

Borrowing Limits

Lenders are usually willing to lend higher amounts under secured loans, again because they are backed by collateral. With unsecured loans, the borrowing limits are generally lower, reflecting the increased risk the lender takes on.

Flexibility

Unsecured loans can be quicker and more straightforward to access. There’s no need for valuations or paperwork related to assets, making them a popular choice for smaller, short-term borrowing. Secured loans, while sometimes slower to arrange, can give you more flexibility in repayment terms and larger amounts.

Risks

With a secured loan, if you fall behind on repayments, the lender has the right to repossess your asset. With unsecured loans, your assets aren’t directly at risk, but defaulting can still have serious consequences, such as damaged credit, legal action, or higher costs down the track.

Choosing the Right Loan: Factors to Consider Based on Your Financial Situation

Picking between a secured and an unsecured loan really comes down to your own situation. A few things to keep in mind:

Your Credit Score

A strong credit history makes it easier to access unsecured loans at good rates. If your score isn’t where you would like it to be, a secured loan may give you better chances of approval.

Loan Purpose and Amount

Smaller, short-term needs are often best suited to unsecured loans. If you are after a larger sum or a longer repayment period, a secured loan may be the way to go.

Repayment Comfort

Look at your budget. Lower repayments over more years might feel easier, but could cost you more in the long run. Shorter terms mean higher instalments but quicker debt clearance.

Secured vs Unsecured Loans: Choose the Right Path with National Finance

You are already equipped with the knowledge of secured vs unsecured loans, and now it is time to take the next step toward achieving your financial goals. Whether you’re looking to finance something essential or seize an opportunity, National Finance is here to make the process simple and stress-free. Visit the branch nearest to you or contact us directly, and let us help you find the right loan option that fits your needs.

At National Finance, our commitment to providing fast loans with competitive rates is unwavering. From secured vs unsecured loans, we ensure you have access to solutions that are flexible, reliable, and tailored to your circumstances. Count on us to support you every step of the way so you can focus on moving forward, no matter what your financial goals may be.