Raising a child is a bit like planting a tree, you water it, nurture it, and protect it from storms, all in the hope it will grow strong and steady. But just like a tree needs fertile soil, your child’s education needs solid financial ground. And with the cost of education rising each year, saving for 2026 school fees isn’t just a smart move, it is a seed you will want to plant now before the seasons change.

If you have ever looked at school invoices and wondered how they add up so quickly, you are not alone. The truth is, saving for 2026 school fees doesn’t have to be stressful or overwhelming, not when you have the right plan and the right people behind you. Today, we will walk through practical tips and fresh ways to ease the pressure, and show you how National Finance can help make your goals feel a little more within reach.

What’s Inside:

- Understanding the Education Landscape in PNG: What to Expect in 2026

- Planning Ahead: Saving for 2026 School Fees with National Finance Budget

- Saving for 2026 School Fees: Let’s Make a Plan Together

Understanding the Education Landscape in PNG: What to Expect in 2026

We all want to give our kids the best start possible, and that begins with being ready. So, before you set your savings goals, let’s take a quick look at what school might look like in 2026 across Papua New Guinea:

Investment in Early Learning

In May 2025, the World Bank confirmed a US$100 million investment under the LEAP programme, benefiting over 375,000 children by improving classrooms, materials and support for around 9,000 teachers. This investment emphasises the PNG Government’s long-term focus on foundational education, support likely to translate into enhanced early childhood outcomes in 2026.

Education Access and Quality

While enrolment in secondary education has historically been a challenge, recent years have shown gradual improvement. Today, more initiatives are focused on expanding access and improving quality. With ongoing reforms and growing investment in the education sector, parents can expect broader opportunities for students to complete their secondary schooling by 2026. This means planning ahead for school fees is more relevant than ever.

Access Gaps Between Regions

Education costs vary depending on location, with urban centres like Port Moresby and Lae generally having higher fees than rural areas, alongside a wider selection of schooling options.

Curriculum Reform and Relevance

Ongoing curriculum reviews will aim to ensure that learning remains culturally relevant and practical, equipping students with skills for everyday life and future employment. There is a growing emphasis on vocational and life skills education, reflecting the needs of PNG’s diverse communities.

Planning Ahead: Saving for 2026 School Fees with National Finance

Sending your child to school is one of the most meaningful investments you can make, but it requires careful planning, especially as costs continue to rise. Whether you are a parent or grandparent, preparing early can take the pressure off when the 2026 school year arrives.

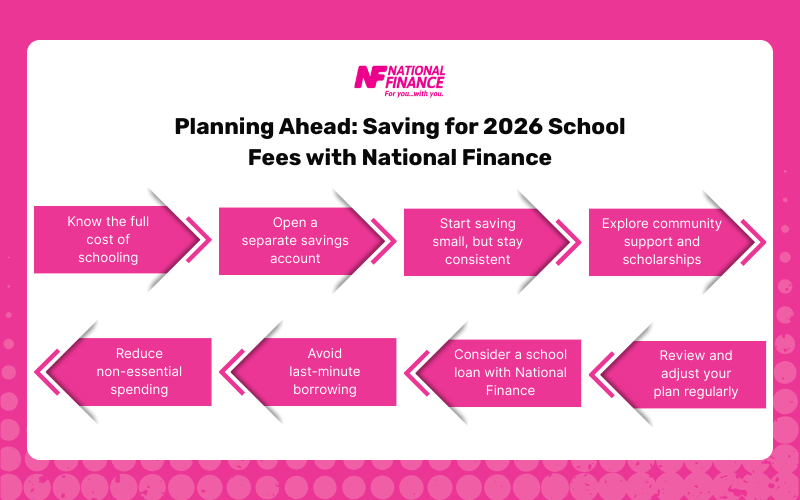

Here are some tips for you to prepare for saving for 2026 school fees:

Know the Full Cost of Schooling

Start by getting a clear picture of how much schooling will cost in 2026. Consider not just tuition, but uniforms, transport, stationery, and boarding if required. Knowing the full amount early helps you set realistic savings goals.

Open a Separate Savings Account

Set up a separate account just for school-related expenses. This prevents the money from being used for other needs and gives you a clear view of how much you are saving. Some PNG banks also offer targeted savings options. Look for one that suits your budget.

Start Saving Small, But Stay Consistent

Even small weekly contributions can add up over time. Whether it is K10 or K50 a week, the key is consistency. Set a regular transfer from your main account into your school fees fund and treat it like a must-pay bill.

Explore Community Support and Scholarships

Check with your child’s school or local community groups for scholarship opportunities or fee assistance programs that may be available.

Reduce Non-Essential Spending

Take a look at your current expenses and identify areas where you could cut back. Reducing things like takeaway meals, entertainment, or impulse purchases can help you redirect more money towards school savings.

Avoid Borrowing from Loan Sharks

They often use harsh tactics—like taking your debit card and withdrawing cash at ATMs, and pressure you to repay in ways that can damage your finances and wellbeing. Choose a trusted PNG personal lender with clear costs, written agreements, and a predictable repayment plan.

Consider a School Loan with National Finance

If you are worried your savings won’t be enough, speak to National Finance about our flexible school loan options. We offer personalised repayment plans, fast approvals, and a supportive team that understands the pressures PNG families face at back-to-school time.

Review and Adjust Your Plan Regularly

Life circumstances can change, so revisit your savings plan every few months to ensure it still fits your budget and goals.

Saving for 2026 School Fees: Let’s Make a Plan Together

Saving for 2026 school fees might not be the first thing on your mind right now. It is completely normal to feel unsure about where to begin, but you don’t have to figure it out alone. But a little planning today can make a big difference tomorrow. Even if you are putting away bit by bit or looking for extra support, a school loan from National Finance can help take the pressure off.

We have helped families across Papua New Guinea plan ahead for school fees with confidence. Whether you want to get started with a school loan or just need someone to talk it through with, National Finance is here for you. Saving for 2026 school fees is a journey, and we will support you every step of the way.