School loans in PNG can feel like carrying a heavy backpack that never comes off. For students, it is the weight that follows them from classroom to classroom, and for parents, it is the quiet reminder sitting at the kitchen table long after homework is done. These loans aren’t just numbers on paper, they shape decisions, create pressure, and often determine the path forward.

But the story doesn’t have to stop with stress and sacrifice. Money can be managed, and loans can be tackled with steady steps rather than rushed leaps. We are here to hand you the map and the compass, practical tips that show both students and parents how to move forward with confidence. Keep reading, because turning that financial weight into progress starts right here.

What’s Inside:

The Realities of Funding Education in PNG

For many families in Papua New Guinea, the dream of higher education comes with real financial challenges. Public subsidies are limited, and while government support exists, it is far from universal. Many students and parents find themselves navigating the gap between what is provided and the actual cost of tuition, boarding, and living expenses.

While the government does offer assistance through the Tertiary Education Study Assistance Scheme (TESAS) and the Higher Education Loan Programme (HELP), both options are highly selective. In 2025, TESAS has been allocated to around 15,889 awardees, covering both first-year and continuing students.

Meanwhile, HELP funding was boosted to K53.08 million in the 2025 national budget, but this pool must be shared among thousands of students nationwide. As a result, many families still carry the responsibility of filling the financial shortfall themselves.

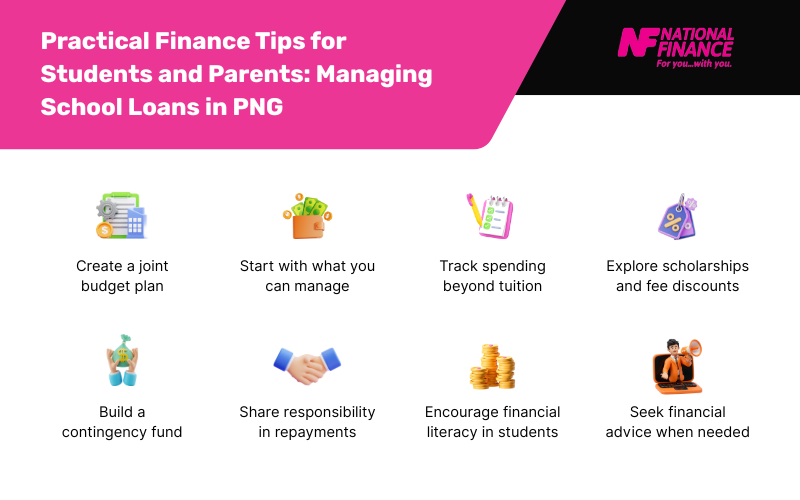

Practical Finance Tips for Students and Parents: Managing School Loans in PNG

While a loan repayment rebate may sound like an easy win, it’s not always the best fit for everyone. The key is to weigh the benefits against the conditions that come with it and see how it lines up with your family’s financial reality in Papua New Guinea.

Behind every student’s success in Papua New Guinea is a family making sacrifices to support their education. School loans are often part of that journey. By managing them wisely, parents and students can focus less on financial strain and more on building a brighter future.

Here are some practical ways you can manage loan funds and repayments effectively:

Create a Joint Budget Plan

Map out tuition, boarding, transport, and living expenses. This ensures both students and parents have a clear picture of how school loans in PNG will be used and repaid.

Start with What You Can Manage

Don’t over-commit to a loan just because you are approved for it. Borrow only what you truly need for fees and essentials so repayments stay comfortable.

Track Spending Beyond Tuition

School fees are just one part of the cost. Keep a close eye on everyday spending, such as lunch money, data plans, and materials, so loan funds don’t run dry too quickly.

Explore Scholarships and Fee Discounts

Parents can negotiate fee plans with schools, while students can apply for bursaries or academic discounts. Combining these with school loans in PNG reduces the total debt burden.

Build a Contingency Fund

Even small contributions from allowances, family market income, or casual jobs add up. A buffer prevents reliance on extra borrowing when unexpected costs arise.

Share Responsibility in Repayments

Parents usually take the lead, but students should contribute where possible, through part-time work or disciplined savings. This builds accountability and lightens the family’s overall financial load.

Encourage Financial Literacy in Students

Parents should actively involve students in basic budgeting and expense tracking. The earlier they learn, the more responsibly they will manage loans and future finances.

Seek Financial Advice When Needed

If repayment becomes difficult, approach a lender or advisor early. Professional guidance can prevent missed payments from escalating into long-term financial strain.

How National Finance Supports Education in PNG?

When it comes to easing the financial burden of education, National Finance (NF) provides practical and reliable support for families seeking school loans in PNG. Here’s how NF helps parents and grandparents manage these costs responsibly:

Personalised Loan Setup and Flexible Terms

Before approval, National Finance works with you to agree on a repayment schedule suited to your needs. Loan terms can range from short to longer durations, depending on your financial capacity and purpose.

Certainty with Fixed Interest and Repayments

National Finance school loans come with a fixed interest rate and fixed repayments for the entire term. This gives families certainty, and repayments remain consistent, making it easier to plan budgets without surprises.

Stress-Free Salary Deduction Repayments

Most National Finance loans are repaid through automatic salary deductions, particularly for employees in the government or private sectors. This seamless process ensures repayments are consistent and reduces the risk of missed payments.

Repayments Matched to Your Living Costs

National Finance carefully matches repayment schedules with your everyday expenses. This ensures you still have enough net take-home pay to cover household needs while meeting school commitments.

Easy Planning with Online Calculator Tools

National Finance offers an online repayment calculator so you can estimate your repayment obligations before committing. This helps borrowers make informed decisions.

Safe and Responsible Lending Practices

National Finance applies strict lending criteria to prevent over-commitment. Before approval, we ensure you will retain sufficient disposable income after loan deductions.

Loan Consolidation for Simpler Management

If you already have multiple loans, NF can help you roll them into one. A single repayment is easier to manage and reduces financial stress.

Focus on Stable Employment

NF primarily lends to employed individuals, creating a stable repayment environment that supports long-term sustainability.

School Loans in PNG: Take Control of Your Education Costs

Every student deserves the chance to succeed, and every parent deserves peace of mind knowing education is within reach. That’s why National Finance is committed to making school loans in PNG accessible, straightforward, and reliable.

By choosing us, you are choosing a partner who understands the importance of education and the realities of family budgets. Apply today to unlock the right loan solution for your needs, or contact our team anytime for personalised advice.